All3 stays top as Banijay buys ESG

All3Media was again the biggest consolidator in UK revenue terms, comfortably outstripping rivals

This is subscriber only content

Subscribe now to keep reading

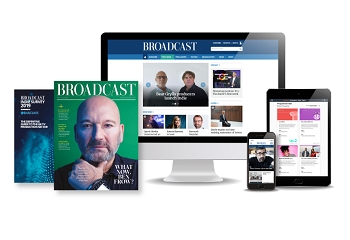

The full subscription package includes:

- Unlimited online access

- Monthly Broadcast Magazine

- Selection of annual reports and surveys

- Newsletters + breaking news updates

- Broadcast mobile & tablet app

- Access to previous digital editions

Access premium content subscribe today

If you have an account you can SIGN IN now