HBO owner opens seven-day window for talks with David Ellison-led company as $31-per-share offer mooted

Warner Bros Discovery has set a date for shareholders to vote on its proposed takeover by Netflix and has also revealed that Paramount is prepared to increase its offer to buy the HBO owner.

WBD said a senior representative for Paramount had informed its board that, if discussions could be reopened, the David Ellison-led company would agree to pay $31 per share, an increase on its existing $30-per-share offer.

The Paramount offer was not its ‘best and final’ proposal, WBD added, with the HBO owner expecting a price in excess of $31 per share.

The potential of an improved bid marks another twist in the long-running saga around ownership of WBD, which said it has set 20 March as the date for its special meeting for shareholders to vote on Netflix’s proposed $83bn deal.

WBD accepted that offer late last year and – despite a series of sweetened bids from Paramount, which has offered $108bn for the entirety of the company – has stuck to its recommendation that Netflix provides best value to shareholders.

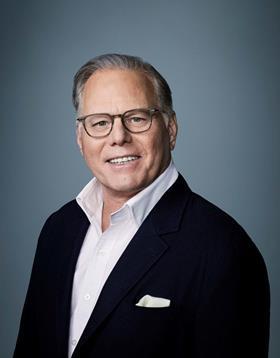

The David Zaslav-led company’s board has again reiterated today that it “unanimously recommends” the Netflix bid but added that the streamer had provided “a limited waiver” that would allow WBD to engage in discussions with Paramount for a seven-day period ending on 23 February.

Shareholder ‘clarity’

WBD said discussions would focus on seeking “clarity” for shareholders and provide Paramount with “the ability to make its best and final offer”.

It added that the offer to pay $31 per share was not reflected in Paramount’s most recent proposal and said it had sent a letter to Ellison’s company setting out the key issues it believes need to be addressed.

These include “many of the unfavourable terms and conditions” from its proposals in December. WBD has highlighted a $1.5bn refinancing fee not applicable to the Netflix agreement, flexibility around bridge loans, and the necessity of additional funding from Oracle founder Larry Ellison - father of David - should Paramount’s own financing for the takeover not be available.

In its letter, WBD said it would discuss Paramount’s proposal, “which we understand will include a WBD per share price higher than $31”.

WBD added: “We seek your best and final proposal. To be clear, our board has not determined that your proposal is reasonably likely to result in a transaction that is superior to the Netflix merger. We continue to recommend, and remain fully committed to, our transaction with Netflix and have scheduled a special meeting of our shareholders on March 20, 2026 to vote on the Netflix merger agreement.”

WBD is providing Paramount with details of the “substantive terms” of the Netflix deal, which Ellison’s company would also need to agree to.

“We encourage you to be direct and transparent with your best and final value and other terms in that binding proposal,” the letter continues.

“During this seven-day period – as we consistently did during the strategic review process last year – we welcome the opportunity to engage with you and expeditiously determine whether [Paramount] can deliver an actionable, binding proposal that provides superior value, transaction certainty and interim protection for WBD’s businesses to Warner Bros. Discovery shareholders.”

WBD chief executive David Zaslav said the company is now engaging with Paramount ”to determine whether they can deliver an actionable, binding proposal that provides superior value and certainty for WBD shareholders through their best and final offer”.

Samuel A. Di Piazza, Jr., chair of WBD’s board, added that the company “continues to believe the Netflix merger is in the best interests of WBD shareholders due to the tremendous value it provides, our clear path to achieve regulatory approval and the transaction’s protections for shareholders against downside risk”.

He added: “With Netflix, we will create a brighter future for the entertainment industry – providing consumers with more choice, creating and protecting jobs and expanding U.S. production capacity while increasing investments to drive the long-term growth of our industry.”

Netflix response

In a separate statement, Netflix said it had “consistently taken a constructive, responsive approach with WBD, in stark contrast to Paramount Skydance”.

The streamer said it remained confident that its offer “provides superior value and certainty” but added that it “recognises the ongoing distraction for WBD stockholders and the broader entertainment industry caused by [Paramount’s] antics.

“Accordingly, we granted WBD a narrow seven-day waiver of certain obligations under our merger agreement to allow them to engage with PSKY to fully and finally resolve this matter.

“This does not change the fact that we have the only signed, board-recommended agreement with WBD, and ours is the only certain path to delivering value to WBD’s stockholders.”

Netflix said it remained confident that its offer would pass regulatory hurdles, and claimed Paramount had “repeatedly mischaracterised the regulatory review process by suggesting its proposal will sail through, misleading WBD stockholders about the real risk of their regulatory challenges around the world”.

The streamer added: “WBD stockholders should not be misled into thinking that PSKY has an easier or faster path to regulatory approval – it does not.”

No comments yet