Majority of respondents report a rise in turnover, with BBCS topping the table

A glance at the figures gathered for Broadcast International’s newly expanded Distributors Survey 2025 highlights that for the vast majority of companies, the past year of operation has delivered a return to turnover growth – but the true picture is more complex and the sector’s leaders are still very cautious despite the uptick in performance.

Most notably, BBC Studios – powered by an 11% rise in distribution turnover to £402m – has reclaimed top spot in our table (right), having dropped to third place last year behind Banijay Rights and ITV Studios. Its two closest rivals (and it is close) have also delivered growth: After The Flood distributor ITV Studios retains second place with an 8.4% rise in turnover to £399m, while Banijay Rights drops two places to third with £396.7m, despite its turnover nudging up 2%.

Distributors table 2025

DOWNLOADBBCS president of global content sales Janet Brown tells Broadcast International that because buyers have become “more selective”, there is an opportunity for companies such as hers to profit, with best-sellers including natural history epics Asia and Solar System.

The cumulative turnover of UK-based distributors has fallen from £1.85bn in 2024 to £1.76bn in 2025, but this is largely due to All3Media International (All3MI) not taking part in this survey after being acquired by RedBird IMI. Had it submitted its numbers, and assuming they were comparable to its 2024 total of £178m, the UK distribution market may well have been pushing the £2bn mark.

Three of the top five UK-based distributors report double-digit percentage rises in turnover, contrasting sharply with last year, when none of the top five achieved that level of growth. Indeed, the picture at the top of last year’s table was far gloomier, with BBCS’s near 28% drop (partly due to a stellar 2023) and All3MI’s 11.8% decline revealing an industry in sharp transition.

On a like-for-like basis (excluding companies that did not report turnover in both 2024 and 2025), this year’s picture is more positive: total turnover has risen by 8%, compared with a Consumer Prices Index (CPI) rise of 3.4% in the 12 months to May 2025. Furthermore, while almost 40% of respondents reported a year-on-year turnover decline in last year’s survey, that number has fallen to just 15% this year.

Pinpoint approach

Brown says that buyers around the world are “prioritising editorial trust and high-quality storytelling that can resonate with a wide audience to attract a consistent and loyal audience base”, with distributors looking to follow suit to make the most of what remains a constrained market.

This pinpoint approach to acquisitions seems to be benefiting most companies’ turnover, but there is little doubt the industry change continues at pace, with viewer fragmentation growing. The word that crops up most commonly from respondents to describe the state of the market is “challenged”.

Among those associated challenges – and one noted by multiple execs at companies big and small – is delays in decision-making because of M&A activity. But there is also a feeling that distributors are seeing some returns from adapting their strategies over recent years, from investing earlier in the cycle to capitalising on areas such as YouTube and FAST.

The focus for many distributors, including ITVS, is on being “nimble” in the face of shifting demand, according to president of global partnerships & Zoo 55 Ruth Berry, and the results appear to be paying off, especially for larger companies.

Yet smaller players are also navigating this evolving landscape, against what has undoubtedly been (another) trying year for those in the unscripted space, both in the UK and globally. Companies such as Borderforce USA distributor BossaNova and Green Eyed Killers firm Orange Smarty have managed to post 18% and 22% bumps in turnover respectively.

The stratification of the sector does not seem to be shifting much, however. Last year, the top seven UK-based distributors accounted for 94% of turnover. Fast-forward to this year and that fi gure stands at 97% (noting All3MI’s absence from the 2025 results).

This year’s survey also includes insights from several major distribution companies across Europe and Asia. The picture is complex but a key takeaway is that respondents delivered growth in turnover but characterise the distribution sector as being strained. This chimes with the fact that 63% of respondents report that the UK distribution market has not had a strong year economically, which is broadly in line with last year, when many companies reported a drop in revenues.

Much of the negative sentiment can be attributed to the ongoing machinations of the US, which remains in the top two most important countries for almost every company featured. This includes many of the non-UK distributors that have provided their insights this year (welcome Studio TF1, Beta Film, Viaplay Content Distribution, Nippon TV, Eccho Rights and Yes Studios).

“Buyers are increasingly selective and conscious of ROI, which can delay the acquisition process”

Ruth Berry, ITV Studios

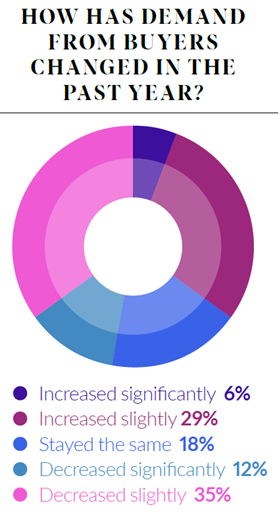

The precipitous drop in US cable network buying is well documented, as is the pull-back from US-based streamers, with buyers now looking evermore closely at the shows on which they are spending money. Demand on a global level appears to vary: 35% of respondents say buying activity has increased this year, up from only 18% in 2024, yet the number of those experiencing a decrease in demand has nudged up from 44% of respondents to 47%.

“Inevitably, demand varies by market but, in general, buyers are increasingly selective and conscious of return on investment, which can delay the acquisition process,” says ITVS’s Berry.

“They are conducting more thorough analysis to give as much certainty as possible in the decisionmaking process. Even where the overall level of demand is static, there is still a healthy appetite for IP that fits platform and broadcaster creative and scheduling needs,” she adds, pointing to acquisitive buyers such as the Nordic PSBs (SVT, NRK, DR, YLE, TV4), Seven in Australia and France Télévisions.

Steady demand

According to Banijay Rights chief executive Cathy Payne, the overarching market conditions are akin to 2024. “The acquisitions landscape is broadly the same as last year, in so much as demand had already decreased and business was challenging,” says Payne, whose company has benefi ted from format stalwarts such as MasterChef during the low-risk buying environment of recent years. “This trend continues as platforms try to balance their books while dealing with several economic challenges in their markets.”

Studio TF1 executive vice-president of international TV and digital distribution Camille Dupeuble agrees. “There are fewer buyers and reduced budgets for linear channels,” she says. “It is diffi cult to read the strategy of SVoD – Amazon and Paramount especially – while for others, priority is given to local content or international content with an Englishspeaking cast.”

“[Buyers are] acquiring fewer brands in smaller quantities than before, as they focus on delivering efficiencies”

Tim Mutimer, Cineflix Rights

Payne also points to the decline in commissioning as companies restructure. “There are buying groups that have been on hold, such as Paramount, while their parent company sale is under process,” she adds.

What is abundantly clear is that buyers are spending ever more carefully – “acquiring fewer brands in smaller quantities than before, as they focus on delivering efficiencies across their platforms,” according to Cineflix Rights chief executive Tim Mutimer.

“They are targeting their spend more than ever, which means they are investing less in acquisitions for linear channels in particular,” adds the boss of the Sunny Nights distributor, who also points to regional nuances such as Central and Eastern Europe (CEE), where linear remains buoyant.

Jonathan Ford, chief executive at Scrublands: Silver distributor Sphere Abacus, also notes that buying patterns are disparate despite a broader bounceback from 2024. The UK and US remain dominant for UK-based distributors, with fellow stalwarts Australia, Canada and Germany among most companies’ top fives.

The prevalence of English-language countries is no great surprise, given that much of the product on sale from UK-based distributors is Englishlanguage. But for non-UK outfits, it is a very different story.

The biggest market for HPI and Cat’s Eyes distributor Studio TF1 is understandably France, but Benelux, Germany, the US and Italy remain key, while Turkey is top for Herbert Kloiber, chief exec at Night Train Media Group and Eccho Rights. Turkish dramas such as Golden Boy remain “the core of our business and their popularity is undimmed”, he says, but shows like Fallen have fuelled growth in Sweden, the UK and Australia.

Viaplay Content Distribution, whose catalogue includes Swedish drama End Of Summer and is almost completely derived from non-UK producers, counts Germany, France, the UK, the Nordics and Poland among its top five, while Yes Studios (Your Honor; Bloody Murray), led by managing director Sharon Levi, has also enjoyed success in the US.

Finished tape has been a trickier sell for Yes Studios over the past year but Levi says that scripted formats remain buoyant. “Once a series is successful and has a good run on any platform, it’s always worth looking into the remake potential of the show,” she says, with her key territories including Germany, France and Italy, as well as India.

Opportunities in Asia

The latter – along with many other countries across the vast Asian continent – is fast becoming a good source of growth among distributors. Matt Ashcroft, chief executive of Parade Media (Find My Country) has also already tapped into this opportunity. He says Pan-Asia is among his company’s top five regions in terms of sales, but most demand is coming from Canada, Australia, New Zealand and North America.

He notes decreased buying activity across several key markets, attributing the lack of appetite to broader market pressures, including “budget constraints, consolidation across media companies, and increased selectivity from buyers who are commissioning fewer hours of original content”.

Ashcroft also points to the longer decision-making cycles that are now in place across a constrained ecosystem, a frequently highlighted challenge.

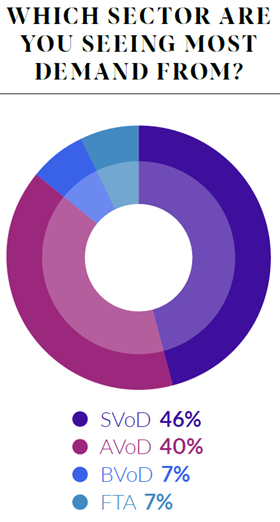

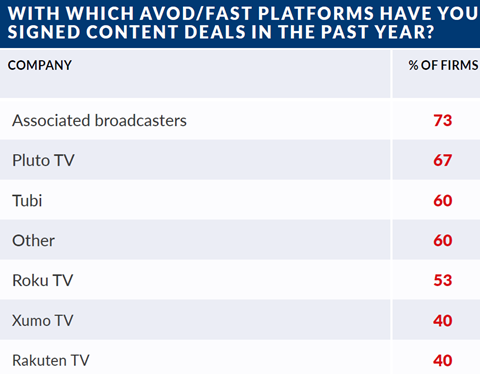

While demand inevitably fluctuates on a country-by-country basis, streamers remain the most acquisitive buyers. Around half of respondents point to SVoD as the area where there is most demand, while 40% cite AVoD services.

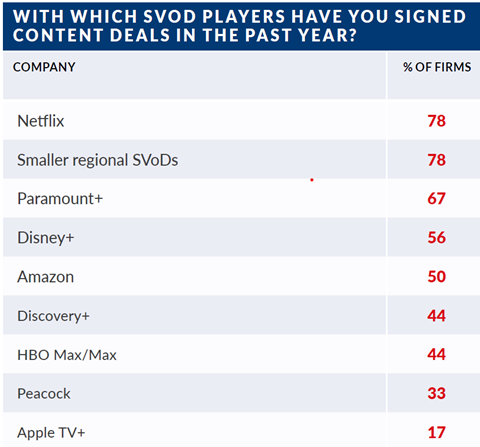

Netflix has led the SVoD charge: in 2024, 71% of companies questioned had secured content agreements with the world’s largest streamer across the prior year. This year, that number has grown to 78%.

Intriguingly, given that it has been at the centre of a protracted merger with Skydance, the only other US-based company to have increased its activity with distributors is Paramount. Its buyers have still been able to strike numerous deals, with almost 67% of companies landing content deals with Paramount+, versus just 59% in last year’s survey.

The picture elsewhere is more predictable, given the US restructuring. Sales to Disney+ and HBO Max are down slightly year on year, while only half of distributors report deals with Amazon Prime Video this year, versus 71% in 2024. Deals with Discovery+ were reported by 44% of respondents, down from 76% last year, while Peacock (33% vs 41%) and Apple TV+ (17% vs 24%) have also shown less appetite. Smaller, regional SVoD agreements remain vital but are also down on last year.

In contrast, the push by broadcasters to engage viewers on their own streaming services is clear, and distributors are cashing in. BVoD sales remain a meaningful part of the business for almost 75% of respondents. Colin Williams, head of Lily’s Driftwood Bay distributor Sixteen South, is among those seeing an increase in AVoD demand, while 67% of companies with AVoD deals report working with Paramount’s Pluto TV. The expansion of Tubi into markets including the UK has also fuelled buying activity from the Fox-owned outfit.

Elsewhere, the excitement around the of potential of FAST channels has become more muted. ITVS, fresh from the launch of digital division Zoo 55 last year, says its FAST revenues over the past year have increased sharply, but most others – including Banijay Rights and Fremantle – reveal more moderate upticks.

There is expansion, however: BBC Studios operates 85 channels, with 18 in the US, which remains by far the biggest FAST market, and Brown says more will come in the next 12 months. She points to single-series channels carrying shows such as Top Gear and Antiques Roadshow as particularly good performers, but the vast majority of distributors only see FAST having a moderate impact on their business in the medium term.

YouTube monetisation

There is far less moderation when it comes to YouTube monetisation, however. More than three quarters of respondents predict the Google-owned service will become a “signifi cant partner” for the exploitation of their long-form programming in the next 12 months, as the streamer continues to disrupt and dominate conversations across the content industry.

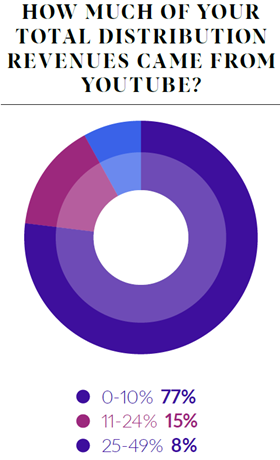

While this may not be coming from a standing start for most – Payne is among several to note that Banijay Rights has been placing content on YouTube for years – it is still at the nascent stage in terms of turnover. More than 75% of companies report that their distribution turnover from YouTube accounts for just 0-10% of their total in this year’s survey, underlining the ambitions for the service’s potential over the next 12 months.

One notable exception to this trend is TVF International, led by Poppy McAlister. The company has utilised its factual-skewing catalogue of 4,900 hours – which includes shows such as Ulysses: From Myth To Science and Untold Arctic Wars: The Cold War – to such eff ect that 25%-49% of its turnover of £16.1m is attributed to YouTube.

“YouTube is rapidly emerging as a primary destination for long-form viewing”

Camille Dupeuble, Studio TF1

There are, of course, other distribution companies around the world that have focused on the earning power of YouTube and derive even more from the platform, but TVFI’s evolution from being a business that had largely focused on more traditional buyers is noteworthy.

“YouTube is rapidly emerging as a primary destination for long-form viewing,” says Studio TF1’s Dupeuble, who adds that her company is adapting accordingly, while ITVS’s Berry explains there are multiple reasons for her company’s focus on the service, which takes place largely via Zoo 55. And they’re not solely based on turnover derived from viewing. “It enables global audience reach, monetisation of our archive and builds IP value through discoverability and engagement,” she says, describing the service as “already a significant partner”.

Fremantle chief operating officer for commercial and international Bob McCourt says his company is also increasing its long-form offering on the service, using library content such as Neighbours and The Bill to engage viewers, while Cineflix’s Mutimer plans to expand its YouTube channel count from 16 to 26 by this time next year. Woodcut International commercial director Koulla Anastasi is also focusing on expanding the company’s offering. “Woodcut has launched five YouTube channels in the past 12 months and our own programming will start to feature more heavily,” she says.

With buyers scrutinising their deals like never before to better secure ROI, distributors are responding by doing the same to their slates, to ensure they’re clear about what every title offers – and at what price point.

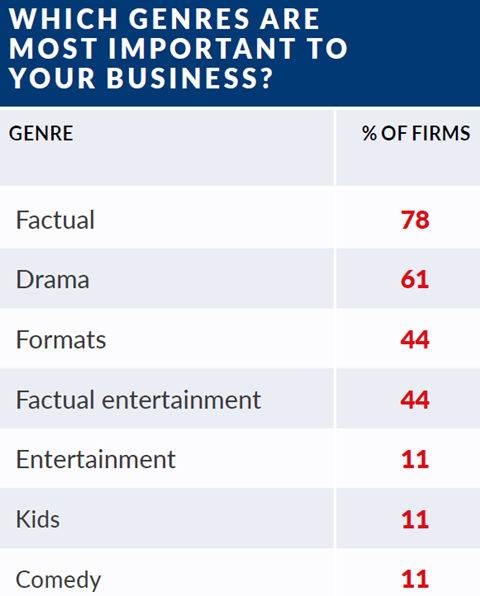

For finished tape, it is little surprise that scripted remains a key focus for the larger players. Fifth Season’s catalogue is dominated by dramas such as Wild Cards and The CW and CTV’s Sight Unseen, and executive vice-president of TV distribution Jennifer Ebell points to high demand for titles “that are best-in-category with well-known talent both in front of and behind the camera”.

“Drama and crime continue to work well for us,” adds Oliver Bachert, chief distribution officer at Germany’s Beta Film. The company doesn’t break out sales numbers but recorded production and distribution turnover of €365m (£316m) in 2024, with Mark Gatiss-starring Bookish and Hudson & Rex driving revenue, and Gomorrah: The Origins soon to launch.

BBCS’s Brown also points to the ongoing interest in thrillers – again of the premium nature – but also underlines “mainstream returners”, arguably an often-overlooked genre by those more focused on critical reception, but a vital revenue driver for distributors.

Death In Paradise remains in the top three best-selling shows for BBCS in 2024/25, while Banija Rights’ equivalent is Aussie soap Home & Away and Fremantle has a second season of Sullivan’s Crossing.

Fremantle’s McCourt says that “mainstream drama” has been a key focus amid a low-risk environment that places increased importance on ROI.

That message is echoed by numerous respondents, , with Hat Trick International director of sales Sarah Tong neatly summing up the types of shows in demand as “those with a proven track record”. The market as a whole, she adds, “is more risk-averse than ever”.

Feel-good formats

Formats are no different: while local remakes of entertainment and dating shows remain popular, getting truly fresh IP away is a Herculean task, particularly in the bigger markets. Much more likely is a spin-off from an existing title that has already cut through or, as Banijay Rights’ Payne puts it, “established formats that have benefi ted from creative renewal”.

BBCS’s Brown notes appetite for “feel-good factual entertainment with a purpose”, while Parade’s Ashcroft points to “home-focused content, particularly shows that off er practical tips, transformations on a budget, or celebrate creative lifestyles”. Such lifestyle-skewing IP can be formatted and “easily localised in multiple markets,” he adds.

This is arguably creating a more diverged unscripted landscape, not dissimilar to the shift in scripted, where mid-budget shows have struggled to find backers.

For many unscripted outfits, turnover continues to be propelled by true crime, while ‘anniversary programming’ is also driving deals. TVF International’s McAlister says that shows with “unique access and/ or new discoveries” are also performing, while Fremantle’s McCourt points to documentaries featuring “well-known personalities and subject matter”, underlining the necessity for programming to have a clearly identifi able attribute (often talent) to cut through the clutter – a particularly important requirement for content going onto streamers.

This is arguably creating a more disparate unscripted landscape, not dissimilar to the shift in scripted that has led to mid-budget shows costing north of £3m per episode struggling to find backers.

“The unscripted market is polarising towards two extremes,” says ITVS’s Berry, pointing to “large-scale, ‘event’ concepts” – such as Shark! Celebrity Infested Waters from its own Plimsoll Productions – and “smaller, high-volume formats”, such as South Shore’s Time Is Money.

“Content needs to ricochet beyond the screen, creating tsunamis across a digital footprint. The dollars invested need to work to much harder”

Karen Young, Orange Smarty

Market conditions continue to drive distributors into all parts of the content business, and to push hard on all fronts to increase turnover. “Content needs to ricochet beyond the screen, creating tsunamis across a digital footprint,” says Karen Young, chief executive and founder of A Place In The Sun distributor Orange Smarty. “You have to ensure that the dollars invested work much harder to gain returns.”

David Hooper, managing director of High Altitude Carpenters distributor Espresso Media International, is among those pointing to “restricted pre-sale” opportunities over the past year, while commissioning has also declined. “As a result, buyers are relying more on co-productions and acquisitions,” adds BossaNova chief executive Paul Heaney, one of the more imaginative deal-makers in the business, with a greenlight process of his own to secure pipeline.

Bethan Corney, founder of Silverlining Rights, adds that her company is looking to get involved earlier than ever to secure programming.

“With fewer rights available there is more competition for content,” says Corney, whose firm has supported shows such as Emporium’s Air India Flight 171 Tragedy: How Safe Is Your Plane?.

“As a lot of our business has traditionally been based on the co-financing model, we are leaning into this more and focusing on getting upstream of content availability and catching titles early. We are also adjusting to focus on fewer titles, where quality shines through, and which we know will sell well, particularly to our key territories and broadcaster partners around the world.”

All of which reflects the fresh approaches that distributors are taking, whatever their size. The market may have picked up on the previous year, but companies need to be very proactive to respond to the speed of change.

BBC Studios comes roaring back as growth returns

Majority of respondents report a rise in turnover, with BBCS topping the table

Currently

reading

Currently

reading

Distributors Survey 2025: BBC Studios comes roaring back as growth returns

- 2

- 3

No comments yet