In a challenging time for the industry, distributors are predicting further consolidation, exploring opportunities in Lat Am and Asia, and betting on YouTube and AI to deliver fresh revenue streams

First, a round of applause for all the Distributors Survey 2024 participants who accurately predicted a bounce back (of sorts) in 2025: almost 90% of respondents last year said they felt more confident about their prospects in the coming 12 months and, in pure turnover terms at least, that has come to fruition.

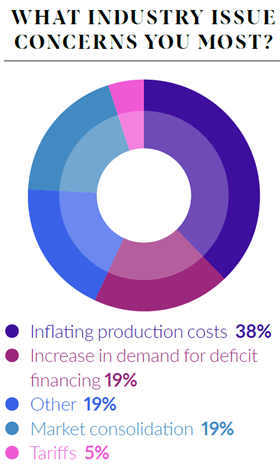

The strain on the sector is abundantly clear, though. More than half of companies in this year’s survey say they feel the distribution market has not had a strong 12 months, with 40% citing production inflation as the issue that concerns them most (this figure stood at 38% last year). The squeezed budgets of buyers and the implications for deficit financing, as well as market consolidation, are all major concerns.

“Production budgets have increased while commissioning broadcaster licence fees have stayed the same, leading to much larger distribution gaps at a time when demand for content has reduced,” says Fremantle chief operating officer for commercial and international Bob McCourt, summing up the concerns.

Studio TF1 executive vice-president of international TV and digital distribution Camille Dupeuble also points to an “unstable and changing” industry, adding that her company is “increasingly seeking new clients and diversifying our revenue streams in order to sustain our activity and compensate for declining demand”. AVoD, FAST and branded content are all focuses, she adds, “with a stronger focus on co-productions and gap financing”.

A similar picture is painted by most companies. Cineflix Rights chief executive Tim Mutimer says the ongoing shift in viewing habits and the pressure on the ad market are having “a huge impact” on the way distributors do business. “Linear broadcasters are prioritising growth from their BVoD services, but they are also competing for advertising dollars with a plethora of SVoD and VoD, social media and gaming platforms,” he adds.

The troubled global macroeconomic environment over the past year has presented another challenge. ITV Studios president of global partnerships & Zoo 55 Ruth Berry says: “Tariffs are out of our control but have not resulted in meaningful impact so far. But we’ve seen how US politics can aff ect advertising and spending sentiment across the world.”

BBC Studios president of global content sales Janet Brown adds: “On a macro level, with discretionary spend often under pressure and advertising growth sluggish, there has been a shift to focus on value, with buyers being more selective and with higher expectations on performance.”

With increasingly selective buyers, distributors are adopting flexible approaches to content investment, she adds, particularly as production costs remain elevated.

“Market consolidation is inevitable and can have the greatest impact on the competitive landscape”

Ruth Berry, ITV Studios

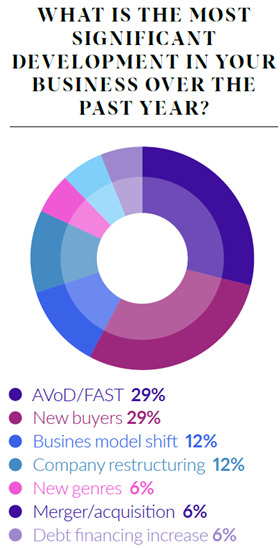

The spectre of more consolidation is also looming following what has already been a fervent period of M&A and studio overhauls, particularly in the US. In most cases, this is reducing the established client base for distributors. “We expect the market will continue to consolidate,” says Banijay Rights chief executive Cathy Payne, pointing out that “the leverage and synergies… can be significant”.

ITVS’s Berry agrees: “Market consolidation is inevitable and can have the greatest impact on the competitive landscape,” she says, pointing to a strategy of communication with clients, “to make sure we’re supplying them with what they need as their creative direction evolves”.

This can be challenging for an industry that in many cases still requires several years to produce high-end scripted content, for example. Delays in decision making, so often cited as one of the main pinch points for producers and distributors alike, seem only to have got worse amid a year of M&A and US studio rejigs.

Sales pauses

Brown is not alone in admitting that BBCS has “experienced some delays and temporary pauses in content sales discussions” owing to ongoing M&A, although she finds a silver lining in the fact that consolidated buyers have been gravitating to known IP. She adds that larger players can also be more open to “creative and innovative partnerships”.

Berry also points to the realignment of budget and creative direction in the US as a challenge, adding that “the speed of engagement is affected by shifting buying teams”. She adds, however, that ITVS is also finding opportunities to target these large buying groups, while pointing to the more recent trend of carriage deals with streamers – such as ITV’s pact with Disney+ in the UK and BritBox content including The Office and Luther landing on HBO Max during a summer ‘pop-up’ event.

On the latter, Berry says ITVS is “being nimble” to support similar agreements, “while valuing the associated rights to aid their expansion”.

Payne also highlights the delaying effect on greenlights caused by US studios Warner Bros Discovery and NBC Universal splitting their cable networks into separate businesses, with unscripted particularly affected. How these standalone companies’ buying habits might shift is yet to be determined, but having two buyers with specific focuses could play out positively for distributors.

BBCS’s Brown sees the development “as more of an opportunity than a challenge”. In a fast-changing landscape, she is aided by knowing which shows perform best on which platforms, providing an advantage when it comes to sales.

“Audience engagement is fundamentally different in a linear versus streaming environment,” she explains. “While these shifts may not yet expand the overall market, they are helping to clarify buyer priorities, replacing a smaller set of mixed needs with a more defined set of targeted opportunities.”

Distributors are well-versed in adapting to industry-wide turbulence and, given their place in the market, have little option but to flex with the conditions. Yet, while the confluence of factors detailed above suggest a sector that remains in a challenging environment, the potential of meaningful direct-to-consumer returns – coupled with developments in AI – is becoming ever clearer.

While a handful of groups may already be able to use in-house streaming platforms to their advantage, YouTube – and, perhaps to a lesser extent, FAST – is now seen as a facilitator that will enable more distributors to go direct to viewers, albeit in many cases via platform specialists.

Woodcut International commercial director Koulla Anastasi says the most significant development for her company over the past 12 months has been investing in owned and operated YouTube channels. “We’ve exploited our own finished tape, acquired third-party [content] for YouTube and are seeking ways to monetise originals made for the service,” she says.

“We foresee YouTube becoming a significant partner for the exploitation of our long-form content in the next 12 months”

Camille Dupeuble, Studio TF1

Studio TF1’s Dupeuble is also bullish. “On TV screens, YouTube now leads viewing globally and holds the largest share of streaming watch time in the US,” she says, adding that the service “is fast becoming an essential platform for multi-format distribution. We foresee YouTube becoming a significant and strategic partner for the exploitation of our long-form content in the next 12 months.”

ITVS’s Berry also points to the launch of digital-focused Zoo 55 – which aims to tap into monetisation opportunities across social channels, AVoD/FAST and gaming – as a key development, but adds that YouTube offers other benefits beyond revenue raising. “As viewing habits shift further towards different platforms, YouTube offers a powerful, data-rich environment to exploit our archive, test new formats, drive audience insights, and also promote new and existing content locally and globally,” she says.

Fremantle’s Bob McCourt is placing a “significant emphasis” on growing his company’s digital and FAST channels businesses, while Tempting Fortune distributor Cineflix Rights is also ramping up investment. More YouTube channels will be added next year, Mutimer says, adding that the company’s first non-English FAST channel, Mayday: Catástrofe Aérea, is being launched.

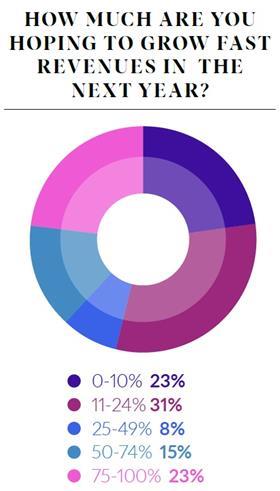

“We have further international non-English expansion planned for that title, among others,” he continues, adding that artificial intelligence is opening up new opportunities. “We’re harnessing AI to help with the localisation of this content, as well as marketing,” he says, with the digital focus currently delivering double-digit revenue growth.

Head of TVF International Poppy McAlister is also targeting expansion in international co-productions, “particularly with new AI-driven tools, which are set to accelerate and streamline the re-versioning process through the generation of subtitles and closed captions”. This will, she adds, “make it faster and more cost-effective than ever to adapt foreign-language programming for English-speaking audiences”.

TVFI is not alone in looking to expand its international co-pro activity, particularly with the extended downturn in the US. Berry says Mexico and Brazil, including local streamers such as Globoplay, have high demand for unscripted, while partnerships with platforms such as CBC and Paramount+ in Canada are enjoying “steady growth”.

The healthy markets in Poland, Hungary and Czechia are also noted by several execs, particularly their appetite for episodic crime procedurals. Germany also offers co-pro potential, says Berry, pointing to ITVS’s co-production with ZDF on Ludwig.

Payne says that EMEA is providing format demand for Banijay Rights, and BBCS’s Brown says she is exploring Lat Am co-productions. She also points to the reorganisation of her distribution operation last November – rolling out the Global Content Sales Division – as a way to gain “global perspective on content demand” and deal-making through shared intel.

Beta Film distribution chief Oliver Bachert also points to shows coming from emerging markets. “Greece has become a source of very diverse and creative storytelling,” he says, highlighting the recently announced The Great Chimera, based on a bestselling novel. “At the same time, we’ve seen the CEE region gain real momentum, producing shows such as the multi-awarded Operation Sabre or Venice entry I Know Your Soul from Jasmila Žbanić, which are travelling very well internationally.”

Heading further afield

While the US and Western Europe inevitably remain key focuses for distributors next year, Lat Am and Asia are among the areas being tipped for growth in 2026. More than half of companies are looking to expand their dealings in East Asia specifically (up from 38% in 2024), while 44% are pencilling in growth in Lat Am (up from 41%).

These targets represent distributors tapping up new buyers and seeking partnerships in what is undoubtedly a challenging environment. Industry consolidation and shifting viewing habits are reducing the range of more traditional clients, while there is increased scrutiny of both acquisitions and co-productions – to ensure they provide ROI – pushing content ever more mainstream.

Matthew Ashcroft, founder and chief executive of Find My Country House distributor Parade Media, says there is a greater focus on proven returnable formats and lower-risk content, as “buyers prioritise value-driven programming over premium spend”.

While this shift has required Parade to adapt, “it has also sharpened our focus on developing scalable, cost-efficient and globally relevant formats with strong brand or talent attachments,” he says. “We’re working more collaboratively with partners to de-risk investments and maximise the life cycle of each title across multiple platforms and territories.”

This is necessary, not least because the sector continues to hurt from the US pull-back, and the dislocation between production costs and returns – especially on drama – remains.

Deficit financing remains a key concern in this regard: “Both broadcasters and producers, at times, are expecting distributors to supply higher deficit funding, but sales aren’t necessarily there to support that,” says Sphere Abacus managing director Jonathan Ford.

Bethan Corney, founder of Silverlining Rights, agrees. “There are bigger gaps to close and fewer opportunities to find the financing to do so. Some producers still have unrealistic expectations of both the size of gaps and risk that distributors can take on but also the number of sales that can be made.

“However, we are finding that the producers we work with are willing to cooperate with us to find ways to spread risk and financial commitments in order to get content into production.”

“There are bigger gaps to close and fewer opportunities to find the financing to do so”

Bethan Corney, Silverlining Rights

The suggestion from many distributors, though, is that even more will be asked of them over the next 12 months, with little sign that production costs will decline. Spreading these increased costs over longer periods may work – but only if demand for the content remains high over the same period.

With such a strained sector, catalogues are being worked increasingly hard and it is here that there seems to be most optimism. For example, distributors are using AI for dubbing and generating returns via YouTube and FAST channels across the world, and these are expected to grow.

It perhaps explains why more than three-quarters of the companies in this year’s survey are more confident about next year than the previous 12 months. Agility in deal-making and flexibility on the part of buyers – especially streamers – seems to be increasing as partnerships take centre stage. However, production costs remain stubbornly high and show little sign of shifting.

“Those who can produce for the available funding will survive,” says Payne, neatly summing up the conundrum facing the industry over the coming years. Whether that’s producing formats via a hub, using a group to support back-end operations on a scripted series, or bringing in new partners such as brands for additional funding, the message from distributors is clear: models are changing fast, but the speed of evolution must not slow down.

BBC Studios comes roaring back as growth returns

Majority of respondents report a rise in turnover, with BBCS topping the table

- 1

Currently

reading

Currently

reading

Distributors Survey 2025: Adapting to a changing landscape

- 3

No comments yet