Survey respondents report having to get creative with deficit financing and co-production to ensure the shows they need make it over the line and onto their slates

Squeezed commissioning budgets across almost all genres is hardly a noteworthy trend for 2025, given its prevalence in recent years, but the eff ect this is now having on the supply of content available for distributors to sell certainly is.

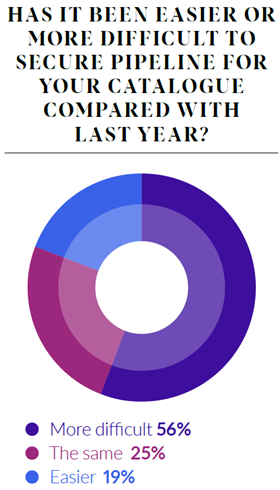

This is most keenly illustrated by the fact that more than half of distributors say they have found it “more difficult” to secure their pipeline this year, compared with the same time 12 months ago, when the fi gure stood at less than a third.

Groups with their own production labels have a considerable advantage, of course, but for almost all distributors in this year’s survey, shows from third-party producers (companies in which the distributor or its parent has no equity share) make up at least 20% of their catalogues. Away from the groups, this soars to above 50% in many cases.

“The increase in production costs for drama and the slowdown in non-scripted commissioning provides ongoing challenges”

Ruth Berry, ITV Studios

Yet the hit on commissioning, which has been fuelled by more scrutiny of ROI from streamers and broadcasters, is also being felt by the giants of the industry and has prompted growing focus on partnerships with buyers.

“The continued increase in production costs for drama and the slowdown in non-scripted commissioning provides ongoing challenges,” says ITV Studios sales boss Ruth Berry, while Banijay Rights chief executive Cathy Payne paints an equally sobering picture of the sector.

“The market is going through challenging times. The pull-back of commissioning in the mid-price unscripted price point in the UK and US is well-documented and there are also many projects still in limbo,” Payne says, with the availability of third-party unscripted product reduced.

It is a similar story across many companies. Bob McCourt, who leads the distribution efforts of My Brilliant Friend and The Responder outfit Fremantle, points to increasing “budget levels” affecting his pipeline, while Hat Trick International director of sales Sarah Tong highlights the effect of consolidation in recent years.

“There are fewer independent production companies that control their rights, plus there are bigger deficits on both factual and scripted. It means investment is riskier,” she says.

Approaches to this challenging environment vary: the trend of distributors forking out deficits continues despite the clear pressures, but partnerships with outfits around the world are increasingly key, both on the supply side and the demand side.

TVF International has expanded its catalogue to 4,900 hours – a 350-hour bump, spanning unscripted series to single documentaries such as Welcome To Babel: Painting Communism, in just a year – despite “commissioning challenges across the UK and North American markets,” says TVFI sales chief Poppy McAlister.

She adds that this has been possible because of international reversions and collaborations with independent producers in non-English-speaking regions such as Japan, Korea, Germany and China.

“We are not dependent on UK commissions to deliver this volume of factual programming, as the opportunities simply aren’t there,” McAlister adds, while the resultant “truly diverse, globally sourced catalogue” resonates with buyers.

BossaNova chief executive Paul Heaney is also more upbeat, pointing to a Mipcom slate that is about three times bigger than last year’s.

“There’s no point, however, in just piling up new content,” he says. “Everything we market or launch has to have grunt in the market and do a job for us. It is sanity rather than vanity.”

Label investment

For larger players, investment in labels is one strategy and BBC Studios president of global content sales Janet Brown highlights her company’s stake in Sophie Leonard and David Hodgkinson’s Samphire Films, struck in February – the latest addition to its considerable list of production banners.

“The team at Samphire are respected both by UK and US commissioners, with a proven track record in delivering ambitious and compelling unscripted programming spanning premium documentary to globally renowned factual formats,” Brown says. “In a challenging market, creatives are more open to partnerships and BBC Studios can offer a range of solutions to working with us.”

However, in such a competitive market, landing talent can be expensive and, Brown admits, investment cases can be challenging, “particularly in premium scripted, with a softer US market”.

First-look deals have remained largely static, but companies such as Chateau DIY distributor Cineflix Rights are aiming to be opportunistic, securing shows as a result of the shifting strategies of larger groups, some of which “are becoming more focused on extracting value from the biggest brands produced by their internal labels,” says chief executive Tim Mutimer.

Filling production deficits also remains a key activity for the distribution sector. “There is a lot of content being made across the UK, North America and Australia/New Zealand, where producers are fully aware from the outset that they will need to bring in a distributor to bridge financing gaps,” continues Mutimer, adding that production company approaches are frequent and, increasingly, at an early stage.

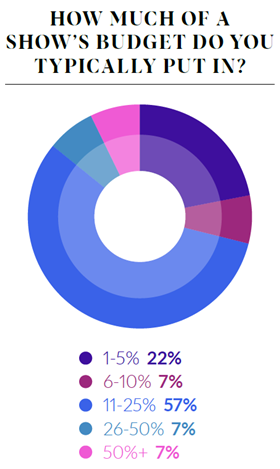

The level of deficit financing across genres varies widely, but only 57% of respondents say they typically provide gap funding of 11%-25%, down from 69% last year. There has also been a corresponding increase at the lower end, with 21% of distributors typically putting in 1%-5% on a show, versus just 8% last year.

Yet 57% of companies again report that the level of their deficit financing activity has increased over the past year, cementing an ongoing trend from 2024, when the figure stood at 60%. Much has been written about deficits – particularly in scripted - reaching unfeasible levels, yet activity seems to be increasing.

Banijay’s Payne, whose company sells dramas including Peaky Blinders and recent BritBox acquisition The Hardacres, says the total investment in deficit financing from her company has stayed the same. But she underlines that “the major proportion” goes on scripted, which has struggled, with once reliable US co-production partners pulling back.

BBCS’s Brown cites “strategic bets to support creative endeavours” in her bid to find returnable series, with choices based partly with a view to supporting UK broadcasters and producers “in a challenged market”.

Mutimer adds that Cineflix’s focus is on “marquee drama”, often based on bestselling IP, with shows such as USA Network’s procedural Anna Pigeon and BBC1 drama Virdee.

While distributors of all sizes might be employing strategies designed to help them tip-toe their way around deficit financing duds, the strain is clear.

“In drama and blue-chip natural history in particular, we are feeling stretched,” says ITVS’s Berry. “The conundrum of trying to match cost, creative ambition and fl at or lower commissioning licence fees with international value and a slow co-pro market is ongoing, and requires us all to work together more closely and share the financing risks.”

“Expectations of how much deficit distributors can cover while commissioning budgets decrease have become unrealistic”

Tim Mutimer, Cineflix Rights

Mutimer says producers are getting more realistic about what’s possible for distributors, while he focuses on “not overpromising what we think we can recoup and then underdelivering”. But he also underlines that the mindset shift has some way to go yet.

“Over the past few years, the expectation of how much deficit distributors can cover while commissioning budgets have stood still or decreased has become unrealistic in some cases,” he says.

Silverlining Rights chief, Bethan Corney, adds: “The increasingly challenging market has led to producers – aware of our success in co-financing projects – coming to us with larger gaps to close than previously. With the market for finished content with international appeal more competitive than ever, we see better value as a distributor in leaning more into presales at an early stage to secure content, and working with producers and broadcasters to provide the financing needed to get shows over the line, particularly in fast-turnaround content, where we have managed to close multiple presales.”

Corney points to docs on the Air India disaster, the Bayesian superyacht sinking and the Singapore Airlines flight hit by severe turbulence as examples.

“The share of presales has grown significantly as distributors are increasingly involved upstream in the production process”

Camille Dupeuble, Studio TF1

Camille Dupeuble, executive vice-president of international TV and digital distribution at StudiobTF1, agrees: “The share of presales has grown significantly as distributors are increasingly involved upstream in the production process to support financing,” she says.

Mutimer also points to increased flexibility from producers, who he says are “getting better at making content more cost effectively and sharing risk – for, example by deferring production fees”. This strategy, he adds, has driven “multiple series into production”.

In unscripted, a “calculated risk” approach remains the best strategy for TVFI’s McAlister, particularly when it comes to documentaries. “We see this not just as a challenge but as an opportunity. By coming on board at an early stage, we’re able to support producers both financially and editorially, guiding projects to have global appeal rather than being tailored solely for local markets.”

BBCS’s Brown adds that “expectations remain high,” pointing to the need for multiple partner models to make the economics work longer term.

Co-production increase

While numerous high-end scripted projects have stalled in the UK, largely because of the US streamers’ lack of co-production activity, the model remains in play at a broader level. Almost 50% of respondents report an increase in their involvement in co-pros, up from 27% last year.

ITVS says this is in part due to unscripted projects, while TVFI points to blue-chip natural history co-productions such as China’s Wild Secrets, narrated by Stephen Fry, with Chinese broadcaster BiliBili, and Japan’s Wild Side, co-developed with long-time partner Tokyovision.

BossaNova’s Paul Heaney also reports an uptick on the unscripted side, largely because of his ‘Development Day’ in October, which he describes as “a key cog” in his business.

“This is our major greenlight strategy in terms of co-production. It’s the main way we can control the type of content we want to bring into the company,” he explains.

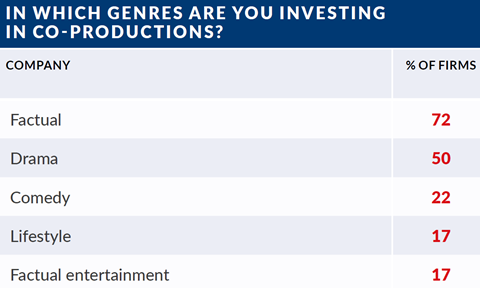

Co-production is a competitive business, however, with 72% of respondents reporting involvement in factual co-pros, up from 67% in 2024. Drama, comedy, lifestyle and fact-ent co-production activity all remain largely stable.

BBCS’s Brown highlights the company’s 10-year co-production partnership with PBS on recent titles such as Walking With Dinosaurs and next year’s Matriarch, although the US broadcaster’s domestic funding issues underline how quickly a turbulent world can affect potential buyers.

Yet it also reflects how distributors are looking to spread bets. Brown explains that as well as the PBS deal, a second series of Moonage Pictures’ A Good Girl’s Guide To Murder was backed by Netflix, German broadcaster ZDFneo and the BBC.

Development spend has also remained largely stable, but distributors are looking to partner ever-closer with buyers and producers to mitigate risk and assist sales.

“With an increasingly competitive market for finished content, we’ve focused our acquisitions strategy more towards investing at an earlier stage, where we see better value,” says Silverlining’s Corney. “For example, providing funding to share development costs, which allow producers to secure access to key contributors and produce a glossy sizzle, which we can then take out to market to raise the full budget.”

Leveraging library content with first windowing of the associated spin-off has also become a play for some – for example, in BBCS’s recent deal with US network Ovation, veteran drama series Death In Paradise was sold alongside the domestic premiere of Return To Paradise, while the US and UK versions of Ghosts aired back-to-back on CBS.

But it was perhaps the co-exclusive deal for The Jetty in the US – the show landed on both the BBCS’s own streamer BritBox and Disney’s Hulu – that best reflects the state of the market at present.

Ensuring a refreshed pipeline of programming for buyers and delivering returns from sales is a complex task but, for most companies, flexibility and pragmatism rule above all else to secure reach and revenues.

FRENCH EXPORTS STAY ON TRACK AS REVENUES RISE

French export body Unifrance and funding agency the CNC revealed in September that international sales of the country’s shows remained stable in 2024, with revenue rising 3% to €209.6m (£182m). Scripted was strongest, generating €75m, but animation and documentary were both down.

CNC director of research Cécile Lacoue points out that 2024 marks only the fourth time that international sales have exceeded the €200m (£173m) mark. Notably, non-French investment in pre-sales and co-productions soared, with the latter up almost 60% year-on-year to €116m (£100m). Pre-sales revenue, which fell sharply in 2023, recovered in 2024 by more than doubling to €75.4m (£65m).

BBC Studios comes roaring back as growth returns

Majority of respondents report a rise in turnover, with BBCS topping the table

- 1

- 2

Currently

reading

Currently

reading

Distributors Survey 2025: Content pipeline slowdown takes a toll

No comments yet