Following its Q2 earnings, GlobalData analyst Jemma Preston outlines the global streamer’s content strategy and key areas of growth

![]()

Analysts at Broadcast’s parent company GlobalData share insights into the possibilities offered by the streamer

In the second quarter of 2025, streaming leader Netflix reported $11.1bn in revenue, a healthy 16% YoY increase, and an all-time high operating margin of 34%.

Key messages from its letter to stakeholders highlight a robust growth trajectory, “a function of more members, higher subscription pricing and increased ad revenue”. This places the business in a better position than expected, with revenue forecasts of FY2025 increased to between $44.8bn and $45.2bn, up from $43.5bn - $44.5bn previously.

The main driver, however, remains content, with the streamer emphasising its power in generating subscriber retention as well as word-of-mouth acquisition. Here, we delve into Netflix’s content strategy, focusing on its priorities, successes, and future directions.

“Of the 34 English-language shows which appeared in Netflix’s global Top 10 for three or more weeks in H1 2025, 28 were drama series”

In its fourth quarter earnings letter for 2024, Netflix articulated its priorities for 2025, emphasising the need to deliver “more series and films our members love”. This strategic focus is already yielding results, with four films and two series from the year so far making it into Netflix’s all-time most popular lists.

Notably, Adolescence, a four-part drama out of the UK that centres on a 13-year-old accused of murdering his classmate, has become the second most popular English-language series.

Elsewhere, the third season of South Korean dystopian drama Squid Game ranks as the third most popular non-English language series, while seasons 1 and 2 sit at first and second.

Netflix is also focusing on building out its live programming offering, following the success of last year’s events. Those included the Jake Paul vs. Mike Tyson boxing bout, which was the most-streamed sporting event in history, and the two most-streamed NFL games ever on Christmas Day.

WWE Raw has also appeared in Netflix’s global Top 10 list every week since it first launched earlier this year on 6 January, with the first episode receiving 5.9 million views in its debut week. Another boxing fight, marketed as Katie Taylor vs. Amanda Serrano 3, landed on 11 July and drew in nearly 6 million viewers globally, becoming the most-watched professional women’s sporting event of the year so far.

Scripted prominence

Drama continues to perform exceptionally well for Netflix, driving billions of views across the globe. Indeed, the streamer’s top 10 all-time most-popular English and non-English series are all dramas.

Season 1 of The Addam’s Family spin-off Wednesday tops the English-language list with 252 million views in the first 91 days of its release, while Stranger Things and Bridgerton each feature twice for separate seasons.

Of the 34 English-language shows which appeared in Netflix’s global Top 10 for three or more weeks in H1 2025, 28 were drama series.

A closer look at commissioning data from our Broadcast Intelligence Programme Index tool reveals that Netflix is increasing not only the volume of drama productions, but also their proportion within the overall slate.

31% of Netflix’s 2024 commissions in the UK and US were dramas, compared with 21% in 2023, almost tripling their drama output year-on-year with 46 shows in 2024.

While drama dominates in the US, factual continues to be the biggest area of focus in the UK, making up over 40% of 2024 and H1 2025 productions.

Unscripted series function as a retention tool for Netflix, allowing the streamer to sustain its content output during the quieter periods between bigger scripted releases. Given Netflix’s successful financial performance and its increased volume of dramas over the last year and a half, we can expect a continued focus on bigger, more expensive drama productions from the streamer.

Thrillers emerged as the most popular subgenre, followed by crime and comedy drama. According to Netflix’s global Top 10, these have also been the most-watched drama subgenres of the year so far, and this correlation between viewer preferences and commissioning decisions underscores Netflix’s commitment to delivering content that resonates with its audience.

A slower year for content spend so far

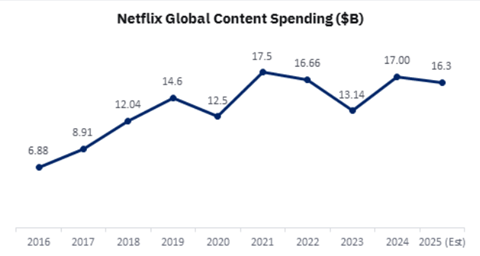

While high-end drama and large-scale live events remain core to Netflix’s proposition, content investment has actually slowed down this year, with its spend coming in under forecasted figures.

Since 2022, Netflix has typically spent the equivalent of 45% of its total quarterly revenue on content, however in H1 this dropped to 38%.

Taking the last two full years as reference, in the first six months the streamer normally spends half of its yearly content output, with Q2 being a main driver. These estimates would forecast a total of $16.3bn in content spend FY2025, a decrease from the $17bn hit last year.

There are other notable trends, particularly Netflix’s push to develop authentic programming that speaks to local audiences whilst also having global appeal. According to the streamer’s biannual What We Watched: A Netflix Engagement Reports, non-English language content made up nearly a third of global viewing on the platform in 2024.

Maximising growth potential in APAC

The success of Squid Game, which remains Netflix’s all-time most popular show, is a testament to the effectiveness of localised content.

The show’s first season, released in September 2021, topped Netflix’s most popular non-English shows list for nine consecutive weeks, and remained in the top 10 for a further 10 weeks.

Despite being released just five days before the end of 2024, Squid Game S2 was the most-watched show of the second half of the year with 87 million views, and season three received the most views of any Netflix show in its first three days.

Shows produced in Asia-Pacific (APAC) countries have featured heavily in Netflix’s weekly non-English top 10 in the first half of 2025. South Korean dramas When Life Gives You Tangerines and Resident Playbook appeared for nine and seven weeks, respectively, and 17 titles in total have spent at least three weeks on the list.

Japanese anime adaptation Sakamoto Days featured for 10 weeks, and Indian series The Royals and Dabba Cartel have also been popular.

At the APAC Film Showcase in Tokyo in April 2025, vice president of content for APAC (ex-India) Minyoung Kim reported that in 2024, “APAC films appeared in the Non-English Film Weekly Top 10 more than any other region”.

With such success, and with such a large volume of high-performing content being produced in APAC countries, it looks likely that this regional focus will remain key for Netflix. In 2024, APAC surpassed Latin America (LATAM) to become Netflix’s third-largest market in terms of subscriber numbers, and GlobalData forecasts a compound annual growth rate (CAGR) of 10% over the next five years, which is higher than for any other region.

GlobalData’s Consumer Survey also found that 66% of respondents from APAC countries subscribed to Netflix, which was the smallest of all regions surveyed. These data together indicate a high potential for growth in the region.

Key European hubs

Spanish series have proved very successful for Netflix, most notably crime thriller Money Heist (aka La Casa de Papel), three seasons of which appear in the streamer’s all-time most popular list. So far this year, The Gardener, The Lady’s Companion, and the fourth season of Wrong Side of the Tracks have each spent three or more weeks in the top 10.

In June, Netflix co-chief exec Ted Sarandos announced that the streamer would be investing over €1bn (£870m) in Spain over the next three years, and reported that “last year alone, Spanish titles generated over five billion hours of viewing on Netflix”.

We can expect to see an increase in Spanish content on the platform as a result of this investment. The streamer has already demonstrated its commitment to creating Spanish programming, as Spain houses Netflix’s biggest studio complex in Europe with 10 soundstages.

In France, Netflix is further championing European content through its recent deal with commercial leader TF1. From Summer 2026, the streaming platform will carry TF1’s on-demand library as well as the broadcaster’s live channels at no extra cost.

Similar deals have already been struck between Prime Video and France Televisions, and Disney+ and ITV, and these innovative distribution strategies are likely to become more common as streamers battle to distinguish themselves from competitors.

New IP vs fan favourites

Over 2024 and H1 2025, 71% of UK and US shows were original, first-time commissions. Limited series thriller Zero Day, which follows former US president George Mullen’s investigation into a cyberattack, spent six weeks in Netflix’s global Top 10 in 2025, while Sirens, The Four Seasons and Running Point featured for five weeks each.

Netflix is also experimenting with new formats, commissioning four episodes of educational children’s show Ms. Rachel.

The programme, which originated as a series on the YouTube channel of social media personality Rachel Anne Accurso, has featured in Netflix’s global Top 10 for 14 weeks so far this year.

The streamer has also picked up season two of Inside from YouTube group the Sidemen, after making its first season available on the platform following its original release on YouTube. Read more about how media companies are leveraging the power of YouTube and its creators here.

However, the recommissioning of popular series also plays a crucial role in Netflix’s content strategy, and new seasons of fan favourites frequently drive views of earlier seasons.

For instance, the release of Ginny & Georgia S3 on 5 June propelled S1 and S2 back into Netflix’s global Top 10 for four weeks. Following a successful run of 10 consecutive weeks in the Top 10 in 2023, S1 of The Night Agent re-entered the rankings for three weeks before the arrival of season two as viewers anticipated its release.

Similarly, the fifth season of You and second season of The Recruit each revived interest in the show’s inaugural season.

Looking at Netflix’s engagement data, we see that first-time commissions and series recommissions are equally represented in the all-time most-watched lists, while new commissions dominate on a week-by-week basis.

By complementing updates to popular IP with a stream of exclusive original releases, the streamer engages new and old audiences alike. This balance is key for driving sign-ups to the service, while minimising churn.

This analysis is a sample of the content that is being created by GlobalData’s Media Intelligence Centre. It helps you stay ahead by delivering real-time insights into emerging trends, changing audience behaviours, and evolving media technology - so you can act faster and make decisions with confidence. Want to see it in action? Request a demo and discover how the Media Intelligence Centre can work for you.

No comments yet